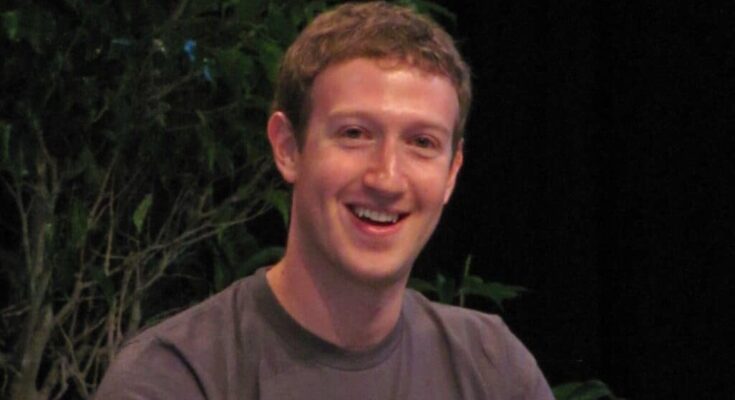

Mark Zuckerberg is quickly climbing the ranks of the world’s richest people, joining the $200 billion net worth club.

Bloomberg’s Billionaire Index figures suggest that the Meta CEO’s wealth has increased by $73.4 billion in 2024, reaching a total of $201 billion. This makes Zuckerberg the fourth richest person globally and one of only four people to hold over $200 billion in personal fortune.

The three others in this exclusive group are Elon Musk, CEO of Tesla and X, with $272 billion; Jeff Bezos, founder of Amazon, with $211 billion; and Bernard Arnault, CEO of luxury brand LVMH, with $207 billion.

Zuckerberg has most of his wealth linked to Meta Platforms stock. In 2024, Meta’s stock has jumped nearly 64%.Last Wednesday, shares reached a record high, closing at $568.31, before dipping slightly to $567.36 on Friday.

Mark Zuckerberg's wealth exceeds $200 Billion for the first time.@elonmusk remains #1 with a net worth of $270 Billion. pic.twitter.com/UlBuyECygv

— Coinsauce (@CoinsauceCrypto) October 1, 2024

Meta owns some of the world’s most popular social media platforms, including Facebook, Instagram, and Threads, along with the messaging app WhatsApp.

Meta AI is on track to become the most used assistant

At the Meta Connect 2024 event, Mark Zuckerberg shared that Meta AI is on the path to becoming one of the world’s most widely used digital assistants.

Zuckerberg said that the tool is nearing 500 million active users each month, even though it has not yet been launched in some large regions, like countries in the European Union.

Zuckerberg is not the only tech billionaire to see a sharp rise in wealth this year. Nvidia’s CEO, Jensen Huang, has seen his net worth grow by $62.2 billion in 2024.

Similarly, Larry Ellison, the co-founder of Oracle, has added $58.6 billion to his fortune during the same period.

Elon Musk, Jeff Bezos, Mark Zuckerberg, and Larry Ellison have all seen significant boosts in their wealth, thanks to the growing excitement around artificial intelligence. Investors are placing big bets on how these tech leaders will use AI to expand their businesses.

For Tesla, AI is expected to advance self-driving car technology and develop humanoid robots. Amazon aims to use AI to enhance its cloud computing and e-commerce operations.

At Meta, the focus is on using AI to elevate social media and digital communication. Oracle, on the other hand, stands to gain by offering its AI data centers to other businesses, providing technology and storage solutions.

In September, the overall stock market experienced a boost when the Federal Reserve cut interest rates for the first time in 18 months. Previously, the rates had climbed sharply from nearly zero to over 5%.

This reduction in rates typically helps drive economic growth. It encourages more borrowing, spending and hiring. Additionally, lower interest rates make stocks more attractive to investors by reducing the appeal of safer assets like cash and bonds.